M & J WILKOW HISTORY

Est. 1939

From our first acquisition in the summer of 1939 to surpassing

$2 billion in assets under management today, M & J Wilkow has been

creating value in real estate for generations.

-

FEBRUARY10, 1939

FEBRUARY 10, 1939 - M&JWILKOW Established

The Wilkow Family arrives in Chicago and M & J Wilkow is established by Robert Wilkow and his sons Mendel and Joseph to invest in real estate assets. Their first office is at 7 South Dearborn Street.

-

SUMMEROF 1939

SUMMER OF 1939 - First Acquisition

Completion of first acquisition, which is a 54-unit apartment building located at 67th Street and Creiger in Chicago. The property is purchased for $92,000 and financed with a $55,000 mortgage loan. In 1953, the property is sold for $240,000.

-

DECEMBER1940

DECEMBER 1940 - First Syndication

Completion of first syndication, raising $25,000 of equity capital to acquire an apartment building located at 55th Street and Everett in Chicago.

-

FEBRUARY1949

-

JULY27, 1956

JULY 27, 1956 - 1400 Lake Shore Drive

Acquisition of stock of 1400 Lake Shore Drive Corporation, thereby acquiring control of the 290-unit apartment tower on North Lake Shore Drive – formerly a “restricted” residential co-op.

-

1963

1963 - First Office Building

Acquisition of first office building – a 300,000 sq. ft. office tower located at 222 West Adams Street in Chicago for $4,282,000. In 1986, the property is sold for $38,721,000.

-

1964

1964 - First Shopping Center

Acquisition of first shopping center – a 232,000 sq. ft. retail property called the Scottsdale Shopping Center (79th and Cicero) in Chicago for $3,200,000. The property was sold in 1978 for $5,375,000.

-

1968

1968 - M & J Wilkow Headquarters – 1968-2015

Acquisition of second office building – a 206,380 sq. ft. office tower located at 180 North Michigan Avenue in Chicago for $6,550,000. The property was sold in 2007 for $22,6000,000. Record for longest holding period.

-

1976–1977

1976–1977 - Fourth Generation

William’s son Clif joins M & J in 1976 – the fourth generation! In 1977, William’s oldest son Marc joins M & J after practicing law for three years.

-

1980s

1980s - Active Investors

M & J assumes operational control of many assets in its portfolio, while building asset and property management groups, thereby transforming itself from a passive investor to an active value creator.

-

1992

1992 - First Institutional Partner

GE Capital becomes M & J Wilkow’s first institutional client/investor in connection with the turnaround of distressed assets.

-

2007–2008

-

AUGUST1, 2013

AUGUST 1, 2013 - 717 Grant

Acquisition of 717 Grant, a 135,000 sq. ft. vacant office building for $3,750,000. A sale of the property is closed on November 13, 2013 for $7,000,000. Record for shortest holding period.

-

DECEMBER31, 2013

DECEMBER 31, 2013 - Portfolio Value Reaches $1B

Property portfolio surpasses 7 million sq. ft. and is valued at $1.12 billion.

-

4THQUARTER 2014

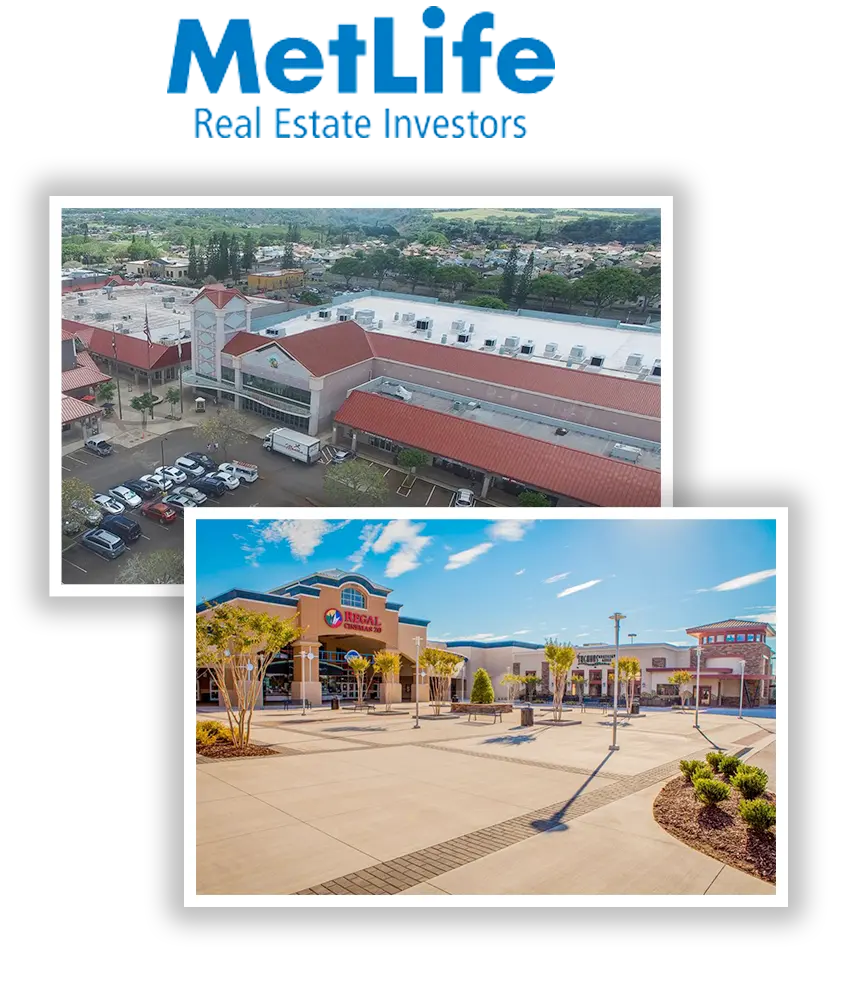

4TH QUARTER 2014 - Magnolia Park and Town Center of Mililani

M & J Wilkow teams up with MetLife to acquire Magnolia Park (468,154 sq. ft.) and Town Center of Mililani (449,112 sq. ft.).

-

JUNE1, 2015

JUNE 1, 2015 - M & J Wilkow Headquarters

M & J Wilkow relocates to 20 South Clark Street in Chicago.

-

NOVEMBER10, 2015

NOVEMBER 10, 2015 - East Gate Square

M & J Wilkow teams up with USAA to acquire the East Gate Square Shopping Center (771,856 sq. ft.).

-

2023

2023 - Portfolio Value Reaches $2B

M & J Wilkow’s property portfolio surpasses 10 million sq. ft. and is valued at $2 billion, with properties located as far west as Hawaii and as far east as South Carolina.

-

2018

2018 - Sale of 600 Battery

The sale of 600 Battery results in our investors receiving an equity multiple of 7.56x

-

2019

-

2021

2021 - Fifth Generation grows

Marc’s son Jordan is elected to M & J’s Board of Directors in 2021, and then joins M & J full time in January 2023

-

2021

-

2022

2022 - Third Party Expansion

M & J Wilkow expands its third-party management program to include Water Tower Place, One Bellevue Place, and CenterSquare’s national Essential Service Retail Portfolio

-

2023